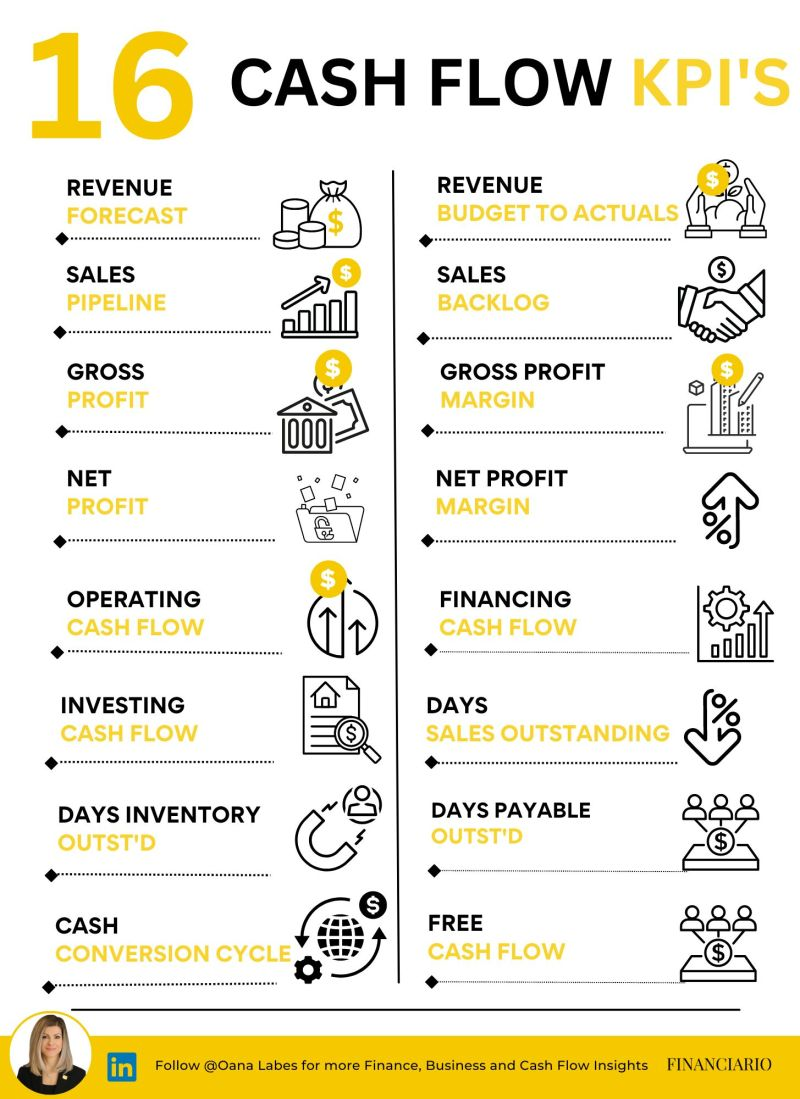

16 cashflow KPI to know

Sales Revenue Forecast

The revenue you expect to generate y/y from normal business operations (e.g. from sales of products and services)

Sales Revenue Budget to Actuals

A comparison of the revenues you budgeted for the period against those you actually achieved, typically broken down by product or service line, and including variance analysis

Sales Pipeline

A list of your current sales opportunities in the process of being closed, together with their individual sales values and their probability of closing during the period.

Sales backlog

A list of your signed sales deals currently in process of execution (i.e. future revenues)

Gross profit

The amount of revenue remaining after accounting for your cost of goods sold or cost of sales (COGS/COS).

Gross profit margin

The percentage of your revenue remaining after accounting for the cost of goods sold or cost of sales.

Net profit

The amount of revenue remaining after accounting for your cost of goods sold or cost of sales (COGS/COS) as well as your operating expenses (OPEX).

Net profit margin

The percentage of your revenue remaining after accounting for the cost of goods sold or cost of sales as well as your operating expense.

Operating Cash Flow (OCF)

The amount of cash generated by your ongoing business operations.

Financing Cash Flow

The amount of cash generated by your financing activities (i.e. borrowing and repaying debt, issuing and repurchasing equity, paying dividends)

Investing Cash Flow

The amount of cash generated by your investing activities (i.e. PPE, investments in other companies, investments in marketable securities)

Days Sales Outstanding (DSO)

The average number of days you take to collect on outstanding customer (AR) balances

Days Inventory Outstanding (DIO)

Average number of days you take to sell your inventory

Days Payable Outstanding (DPO)

Average number of days you take to settle outstanding supplier (AP) invoices

Cash Conversion Cycle (CCC)

The average number of days it takes you to convert your inventory investment into sales, your sales into receivables and your receivables into cash.

Free Cash Flow (FCF)

Net Income + Interest + Taxes + Depreciation/Amortization +/- Non-Cash Items +/- Changes in Working Capital +/- Changes in Fixed Assets

Notes mentioning this note

There are no notes linking to this note.