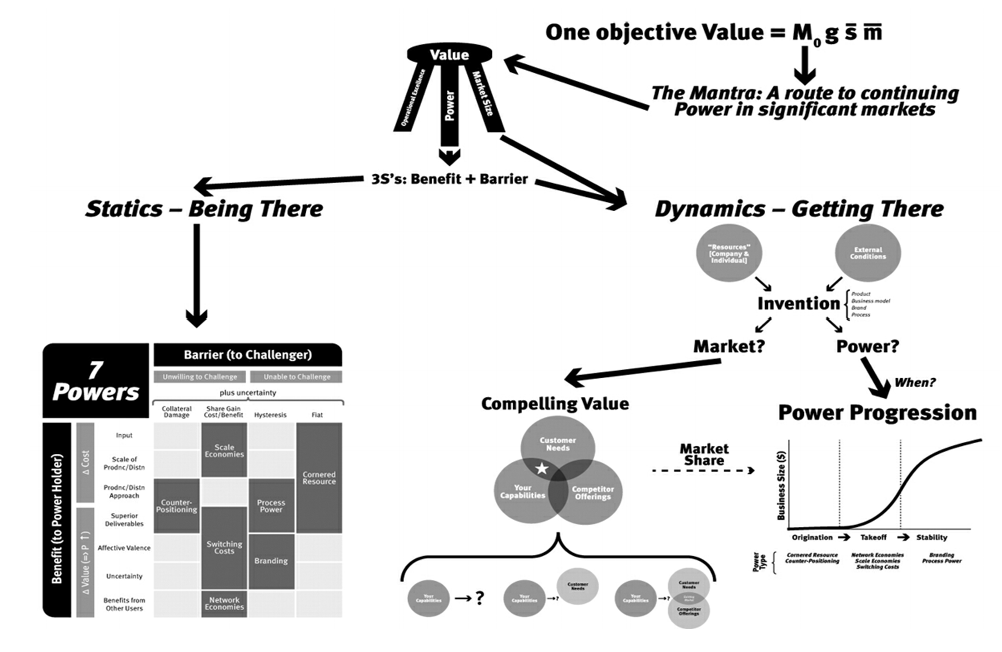

Notes from the 7 Powers - Strategy

Source: [[Helmer-7 Powers]] - the foundations of business strategy

Set of conditions needed for differential returns.

+ Requires Benefit - something that materially increases cash flow (e.g. increased prices, reduced cost, lessened investment needs)

+ and Barrier - to not have value arbitraged out by competition (something that prevent competitors from engaging in value-destroying arbitrage). An obstacle that creates inability or unwillingness to engage in behaviors that would destroy the benefit.

+ Power is a deep driver of potential fundamental business value.

+ Always look for the Barrier first

A route to continuing Power in significant markets.

Strategy dynamics: the study of strategy development over time.

Strategy statics: the study of strategic position at a single point in time

Is the profit margin the business with Power can expect if pricing is such that the competitor’s profits are zero

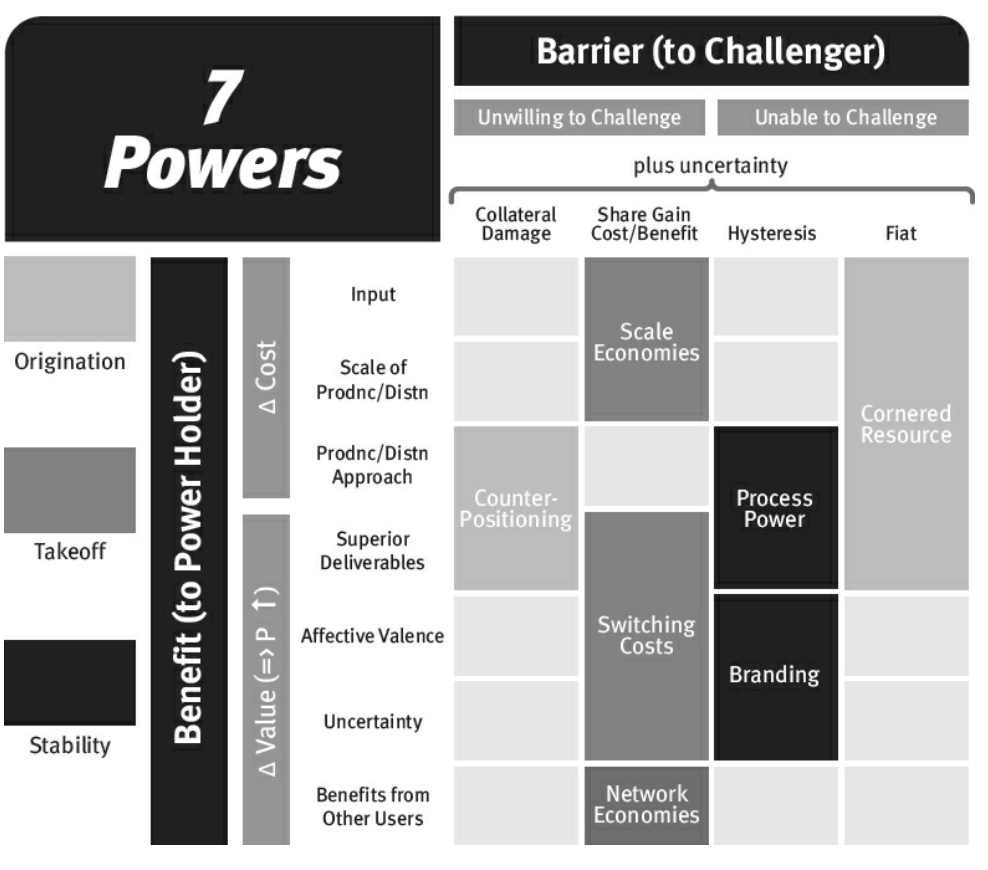

The whole book in an overview

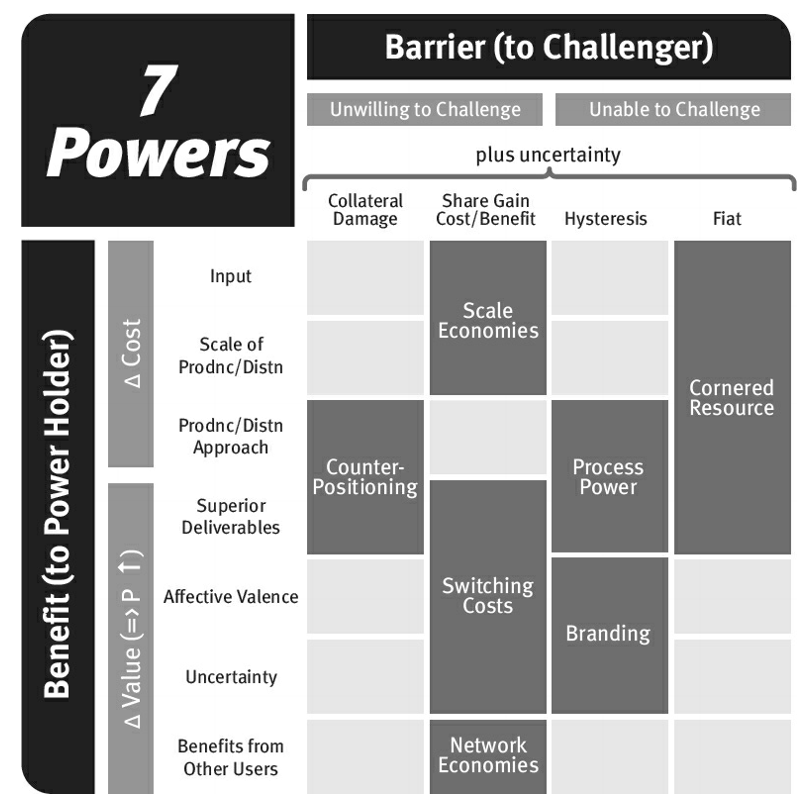

7 Powers in an overview

Full overview on the 7 powers with mapping to benefit and barriers p234

Power 1 - Scale Economics - size matters

- The quality of declining unit costs with increased business size

Benefit

Lowered Cost

example Netflix: Lowered content cost per subscriber for originals.

Barrier

Prohibitive (unerschwinglich) Costs of share gains.

(A competitor would have to offer better value e.g. a reduced price. This can then be captured by the leader they can match the price cut.)

Power Intensity

Industry economics: Scale economy intensity ❓ Competitive position: Relative scale

Further sources

- volume to area relationships (e.g Milktanks delivery vs. delivering in small cans)

- distribution network density (eg. more customers per area so that delivery costs decline)

- learning economies, where learning leads to a benefit (e.g. when you can learn more because you have higher financial freedom and can invest in more learning & experimenting)

- purchasing economics - where a larger buyer can get better pricing

Dynamic view - What must you do to get there?

Simultaneously pursue a business model that promises scale economics and at the same timer offers an attractive product to pull in customers

Power 2 - Network economics - group value

One-hand-shakes-the-other-self-reinforcing upward spirals. The value of the service/product to a customer is increased as new customers join the network and also use the product.

Examples: Facebook, LinkedIn - each users adds value to other users.

- Rapidly scale or die

- winner take all - once a single firm achieves a certain degree of leadership, other firms throw in the towel (example Facebook vs. Google+)

- boundedness - the boundaries of the network effects determine the boundaries of the business (e.g. facebook private life, linkedin - professional network)

- decisive early product - early relative scaling is critical in developing Power … who scales the fastest is often determined by who gets the product most right early on

- also consider demand side network effects

- with important and exclusive complements for each offer, leader will attract further and better complements (e.g. the whole Influencer and Expert add ons in Instagram; or smartphone apps that build on existing apps and infrastructure)

Benefit

- charge higher prices, because it provides higher value through the network (and the power of more users)

Barrier

- unattractive cost of gaining share (what can be extremely high, when one needs to buy out users to join another network)

Power Intensity

Industry economics: Intensity of network effect (how important the network effect is relative to industry cost) Competitive position: Absolute difference in installed base

Dynamic view - What must you do to get there?

In difference to scale economics: Installed base rather than sales share is the goal

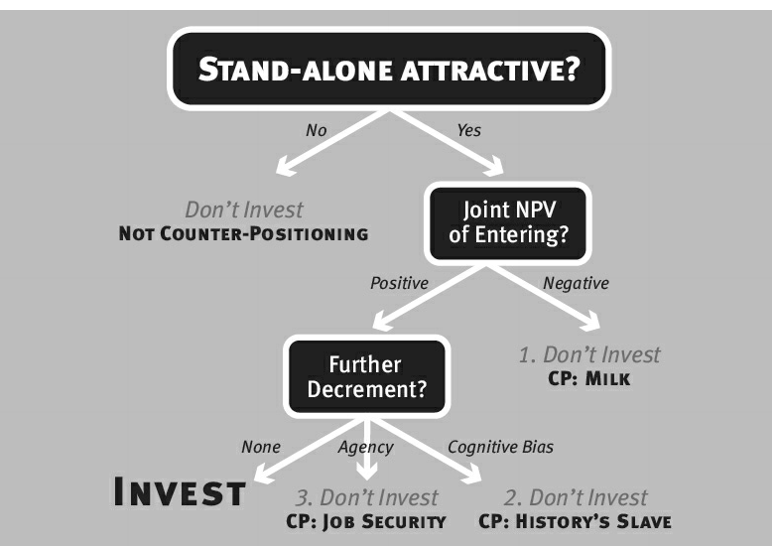

Power 3 - Counter Positioning

A newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.

- an upstart with a superior business model, that is able to successfully challenge well-entrenched incumbents

- steady accumulation of customers, while the incumbent remains paralyzed and unable to respond

- Power only applies relative to the incumbent, but says nothing regarding Power relative to other firms utilizing the new business model too!

- this power is not exclusive

Examples:

- Kodak vs. digi-cams (although for Kodak did not face collateral damage to their film business by the digi-cams)

- Nokia vs. Apple

Benefit

- superior business model due to lower cost and/or ability to charge higher prices (link with Blue Ocean)

- challenger should avoid trumpeting its superiority, instead adopting a tone of respect towards incumbent (so to not wake up a sleeping giant)

Barrier

- inertia from incumbent, either being unaware or observing for too long

- high expected damage for change expected from incumbent that leads to a “no” to change (e.g competing with an already established Franchise e.g. Zooplus vs. Fressnapf)

Reasons for Failure to Mimic

- New superior approach (lower costs and/or improved features). Leading to new Products with high substitution power

- Fast changed technology frontier

- aim to “Milk” a declining original business even though the new model is attractive

- Uncertainty about the challengers approach

- Bias from a currently successful business model

- Job security

Varieties of counter positioning

CP versus disruptive technologies

- core of CP is a new business model

-

disruptive tech does not tell us something about Power

- kodak vs. digital photography - is disruptive tech nut not CP

- In-N-Out vs. McDonals - is CP but not disruptive tech

- Netflix streaming vs. HBO cable - is CP and disruptive tech

5 stages of counter positioning

1) Denial 2) Ridicule 3) Fear 4) Anger 5) Capitulation

Power Intensity

Industry economics: New business model superiority + collateral damage to old Competitive position: Binary: entrant - new model; incumbent-old model

Dynamic view - What must you do to get there?

Pionieer a new, superior business model that promises collateral damages for incumbents if mimicked.

Power 4 - Switching Cost - addiction

The value loss expected by a customer that would be incurred from switching to an alternate supplier for additional purchase.

This power is not exclusive and can also be swept away by technology shifts

Switching Costs arise when a consumer values compatibility across multiple purchases from a specific firm over time. (repeated purchases of the same product or purchases of complementary goods).

Benefit

- charge higher prices - but only when selling follow-on products to the current customers

Barrier

- sunk cost of learning a new system

- competitors must compensate switching costs - so barrier arises from unattractive cost/benefit of share gains

Forms of switching costs

- financial - transparently monetary from outside

- procedural - loss of familiarity with product and risk/uncertainty with new product

- relational - loss of good connections to previous product people

Power Intensity

Industry economics: Magnitude of switching costs Competitive position: Number of current customers

Dynamic view - What must you do to get there?

- First attain a customer base

Power 5 - Branding - feeling good

The durable attribution of higher value to an objectively identical offering that arises from historical information about the seller.

Not exclusive power

Branding is an asset that communicates information and evokes positive emotions in the customer, leading to an increased willingness to pay for the product.

- pitfall lies in diminishing brand by releasing products that deviate from, or damage the brand image

Benefit

- charge higher price

- affective valences - good feelings about the offering, distinct from objective value of the good

- uncertainty reduction - peace of mind

Barrier

- can only be created over a lengthy period of reinforcing actions (hysteresis)

- copycat: long investment runway with no assurance to significant valence and risk of trademark infringement actions

Challenges

- Counterfeiting

- Changing customer preferences

- Geographic boundaries

- Narrowness

- Type of good - for high brand potential it needs 2 conditions

- magnitude

- a promise that justifies the significant price premium

- high perceived costs of uncertainty relative to the cost of the good (e.g. when buying a diamond)

- duration … it needs a long enough time to achieve such magnitude

- magnitude

Power Intensity

Industry economics: Time constant and potential magnitude of branding effect Competitive position: duration of brand investing

Dynamic view - What must you do to get there?

- Over an extensive period of time, make consistent creative choices which foster in the customers mind an affinity.

Power 6 - Cornered resource - mine all mine

Preferential access a attractive terms to a coveted asset that can independently enhance value.

The services of a cohesive group of talented, battle-hardened veterans.

Benefit

- protected talent pool

- preferential access to valuable patent

- access to a required input (e.g. cement)

- cost saving manufacturing approach

Barrier

- personal choice (from a talent)

- patent law

- property rights

5 tests of a cornered resource

- idiosyncratic ❓

- non-arbitraged (not payed an extra price that eats the margin)

- is it transferable

- ongoing

- sufficient for continued differential returns

Power Intensity

Industry economics: Price and/or costs increment due to cornered resource Competitive position: Preferred access at a non-arbitraging price

Dynamic view - What must you do to get there?

Secure rights to a valuable resource on attractive terms.

Power 7 - Process Power - step by step

Embedded company organization and activity sets which enable lower costs and/or superior product, and which can be matched only by and extended commitment

It is rare! as a power.

Example: Toyota Production System (that was build over centuries)

Benefit

- able to improve product attributes and /or lower costs as a result of process improvements

Barrier

- difficult to replicate and can only be achieved of a long period of sustained evolutionary advance

Power Intensity

Industry economics: Time constant and potential magnitude of Process Power effect Competitive position: Relative duration of process power advances.

Dynamic view - What must you do to get there?

- Evolve a complex new process that offers significant advantages over a linger period of time

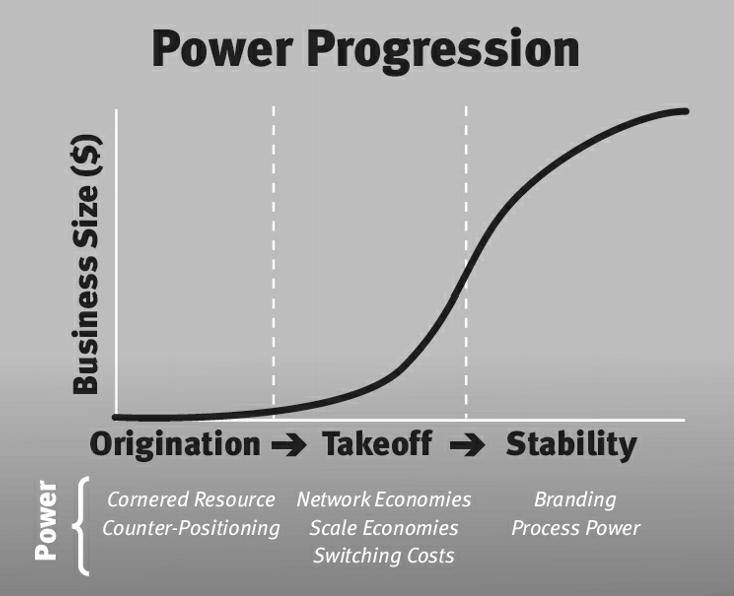

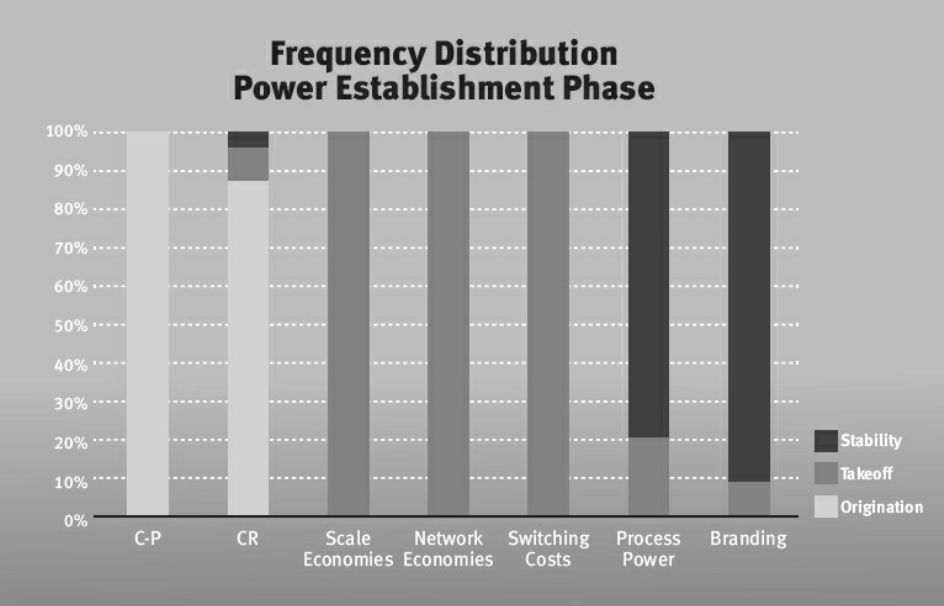

Power Progression for the 7 Powers

Orientation when to chase for what power according to business size

Powers mapped to business stages origination, takeoff and stability p226

Measured distribution of Powers to business stages

3 paths to compelling value - capabilities-led, customer-led, competitor-led

Compelling value requires that you mobilize your capabilities to offer up a product that fulfills a significant customer need currently unmet by competitive offerings.

Capabilities Led

When a company tries to translate some capability into a product with compelling value. Uncertainty: Is there a need?

Customer Led

Many players spy an unmet need, but no one knows how to satisfy net. (eg. Fibric Optics back than) Uncertainty: Can we invent it?

Competitor Led

The inventor must produce something so much better that it elicits the gotta have response. Uncertainty: Will new features be differentially attractive? Will existing competitor sufficiently delay their response?

Seven perspectives on Power Dynamics

Value Axiom

The main objective of Strategy is maximizing potential fundamental business value.

Power 3S - Superior, Significant, Sustainable

- Superior - improves free cash flow

- Significant - cash flow improvement must be material

- Sustainable - improvement must be largely immune to competitive arbitrage

The referred terms benefit and barrier are a combination of 3S in this way:

- Benefit = Superior + Significant

- Barrier = Sustainable

The fundamental equation of Strategy

\[Value = M_0 \times g \times \overline{s} \times\overline{m}\]- Value - absolute fundamental shareholder value (equivalent to Net present value of expected future free cash flow)

- M0 - current market size

- g - discounted growth factor for the market

- s - long term average market share

- m - long term average differential margins (profit margin above that needed to return the cost of captial)

- M x g reflect market scale over time.

Mantra: A route to continuing Power in significant markets

This is a complete statement of the elements of a strategy.

The 7 Powers

- you need to have at least one of these for each competitor

- What power types do I now have?

- What power types do I need to worry about establishing now?

see [[#7 Powers in an overview]]

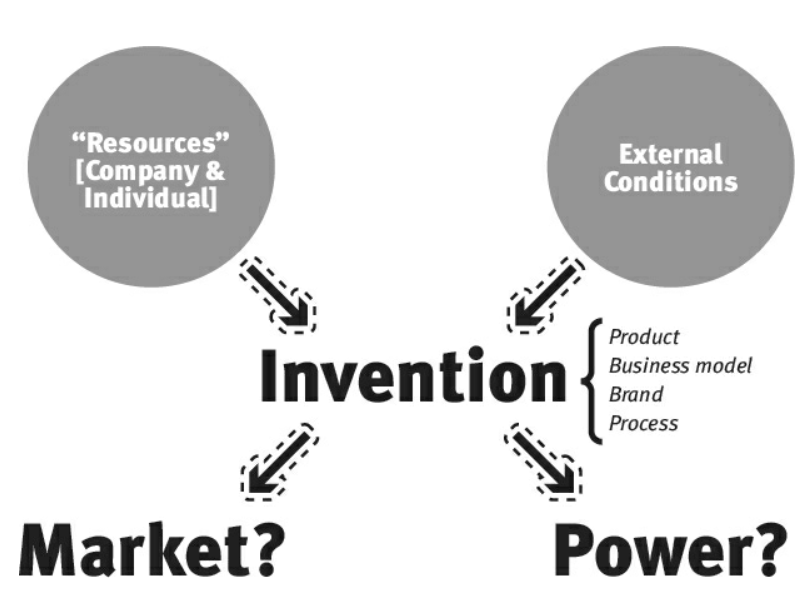

“Me too” - won’t do - It needs invention

If you want your business to create value, then action and creativity must come foremost.

The first cause of a strategy is invention

- all 7 powers involve an invention

- might be invention of product, business model, process or brand

- Inventions lead to a benefit - features, price, reliability. Benefits lead to compelling value.

- 3 paths to compelling value - capabilities-led, customer-led, competitor-led

Invention at the center. Based on invention one can establish power and conquer market. Invention as gateway to power.

Resources

Start with the abilities you can bring to bear. Skills, tools, data, relationships, existing business.

External conditions

technological, competitive, legal

Invention

- breakthrough products

- engaging brands

- innovative business models

Power Progression

see [[#Power Progression for the 7 Powers]]

Further notes

Non Power examples

- UI development - easy to copy a UI

- Recommendation engine - with scale economics accuracy of recommendation increases, but not linear. A smaller competitor can realize most of the same benefit

- it-infrastructure

Linking

- Michael Porter [[Competitive Strategy - Michael E Porter]]

- [[Helmer-7 Powers]] - the foundations of business strategy

- MOC Strategy

- About Wardley Maps

- [[Notes from FOP Bookclub]]

- Blue Ocean Strategy